For years, stock inconsistency has been treated as an operations issue. Warehouse teams get blamed. Staff get retrained. Procedures get tightened. Managers add extra counting steps and verification processes.

But none of that fixes the real problem because the real problem isn’t operational—it’s technical.

Your warehouse probably knows exactly what stock it has. Your team is likely following proper procedures. The counts in your warehouse management system are probably accurate. But somewhere between that system and what customers see on your website, the numbers stop matching reality.

This isn’t about warehouse discipline or staff training. It’s about data synchronization—or more specifically, about how badly most stores handle it. About systems that don’t talk to each other properly. About inventory updates that happen too slowly or not at all. About integration architecture that was set up once, worked well enough to launch, and has been quietly degrading ever since.

The frustrating part is that everyone knows stock inconsistency is a problem. It creates customer complaints, kills trust, wastes support time, and directly costs revenue. But most businesses keep trying to solve it with operational fixes when what they actually need is to fix how their systems communicate with each other.

Let’s talk about what’s really happening and why the solution isn’t in your warehouse.

Why warehouse counts are probably fine

Most warehouses run on decent systems these days. Whether it’s a full WMS, an ERP with inventory modules, or even sophisticated spreadsheets—the actual tracking of what’s physically in the building usually works reasonably well.

When items arrive, they get scanned in. When orders ship, they get scanned out. When there’s a return, it gets logged. Most warehouse teams have daily or weekly cycle counts to catch discrepancies. The physical inventory management is usually solid.

We’ve audited enough operations to know that when you compare what’s actually on shelves to what the warehouse system says should be there, the match rate is typically 95%+ in well-run facilities. That remaining 5% is mostly explainable—items damaged after receiving, inventory in transit between locations, timing differences between physical counts and system updates.

So if the warehouse knows what it has, and customers are buying things that aren’t available or not buying things that are, the problem is obviously somewhere between those two points. The warehouse data is fine. The customer-facing data is wrong. Which means something in the middle is broken.

Yet businesses keep sending their warehouse managers to seminars about inventory accuracy when the warehouse accuracy is already fine. They implement new counting procedures when the counts are already right. They’re solving a problem that doesn’t exist while ignoring the one that does.

The sync gaps that nobody monitors

Here’s what actually happens in most multi-channel setups:

Your warehouse system is the source of truth for physical inventory. Your eCommerce platform needs to know those numbers to show availability to customers. Between those two systems, there’s usually at least one integration point—often several.

Maybe you’re using middleware that pulls data from your WMS and pushes it to your web store. Maybe your ERP connects to both. Maybe there’s a product information management system in the mix. Maybe you’re selling on multiple channels—your website, Amazon, eBay—and they all need inventory data from the same source.

Each of these connections is a potential point of failure. And failure doesn’t always mean dramatic breakage. Often it’s subtle degradation that nobody notices until customers complain.

The sync runs every 15 minutes instead of every 5 minutes because someone changed a setting months ago. An API rate limit gets hit during peak traffic and some updates get dropped. A network hiccup causes sync delays but doesn’t trigger any alerts. One product category has a data formatting issue that prevents stock updates from processing correctly.

None of these problems are obvious. They don’t generate error messages. The systems all report as “working.” But customer-facing inventory is quietly drifting away from reality.

Most businesses don’t actively monitor sync health. They know inventory data flows from point A to point B, and they assume it keeps flowing correctly forever. When stock inconsistencies appear, they investigate the warehouse or blame the web team for configuration issues. Very few people check whether the sync process itself is actually working as intended.

The timing problem that gets worse under load

Even when sync is working perfectly, timing creates problems that most setups don’t handle well.

Your warehouse system updates inventory in real-time as orders are picked. Great. But if that data only syncs to your eCommerce platform every 15 minutes, there’s a 15-minute window where online customers are seeing stale data.

Under normal traffic, maybe this doesn’t matter much. But during a sale or product launch when you’re getting orders every few minutes? That 15-minute lag means multiple customers can buy the last unit because they all checked before the sync caught up.

Or you sell across multiple channels. Someone buys your last unit on Amazon. That sale updates your WMS immediately. But it takes 10 minutes to sync back to your Shopify store, which keeps accepting orders for those 10 minutes. Now you’ve oversold and someone’s getting a refund and a bad experience.

The reverse problem happens too. A large wholesale order comes in through your B2B channel and reserves significant inventory. Your warehouse system knows those units are spoken for. But the reservation doesn’t sync to your retail channels quickly enough, and retail customers buy stock that’s already committed elsewhere. Now you’re choosing between disappointing wholesale clients or retail customers, and either way you lose.

We see stores that handle thousands of orders daily running on hourly inventory syncs. Hourly. Imagine running a busy physical shop where the price tags update once an hour and being surprised when customers get frustrated by pricing inconsistencies. That’s essentially what hourly inventory sync means for eCommerce.

The technical capability for near-real-time sync exists. Most systems support it. But many stores never configure it properly or don’t realize their sync frequency has degraded over time from “every minute” to “every 30 minutes” because nobody’s watching.

The multi-channel nightmare that multiplies problems

Selling on your own website only? Your sync problems are manageable. Selling on your site plus Amazon, eBay, multiple European marketplaces, wholesale portal, and retail partner feeds? Your sync problems just multiplied exponentially.

Each channel needs inventory data. Each channel has different API requirements, rate limits, and update frequencies. Each one can fail independently. Each one creates opportunities for data to get out of sync.

And here’s where it gets really messy: most businesses don’t have a proper single source of truth for inventory allocation across channels. They’re running independent inventory pools—500 units allocated to Amazon, 300 to their website, 200 to eBay—and manually rebalancing when one channel sells through faster than others.

This creates constant fire drills. Amazon stock runs out, but you still have inventory on your website. Someone manually moves allocation. The website inventory drops. But the sync to update the website doesn’t happen immediately, so the site keeps showing higher stock and accepting orders. You’ve just oversold again.

Or worse, you’re using each channel’s built-in inventory tools without any central orchestration. Your WMS says you have 100 units total. Amazon thinks it has access to all 100. Your website thinks it has access to all 100. eBay also thinks 100. Someone could theoretically buy 100 units on each platform simultaneously because none of them know about sales on the others until sync completes.

Smart inventory allocation systems exist. Tools that maintain real-time awareness of stock across all channels, intelligently reserve inventory when orders come in, and update all platforms immediately. But most multi-channel sellers aren’t using them. They’re jerry-rigging solutions with spreadsheets and manual updates and wondering why they keep having stock problems.

The reservation vs. availability confusion

Here’s a conceptual problem that causes practical chaos: most eCommerce platforms don’t properly distinguish between “available” and “in stock.”

You have 50 units in your warehouse. Your system shows “50 in stock” on product pages. Five customers add the item to their carts. Should your system still show 50 in stock? Or should it show 45, reserving those units for the customers who’ve shown interest?

Different platforms handle this differently. Some reserve inventory when items are added to cart. Some only reserve when checkout starts. Some don’t reserve at all until payment completes. And if you’re selling across multiple channels, each one probably has different reservation logic.

This creates scenarios where the math doesn’t work. Your WMS says you have 50 units. Your website has 30 units in active carts (not yet purchased). Your available inventory should be 20. But your website is still showing 50 as available because it doesn’t subtract cart reservations. Customers keep adding to cart. Now you have 80 units in carts but only 50 actually exist.

Some of those cart additions will abandon—that’s expected. But if 60 of them complete checkout, you’re 10 units oversold and you didn’t see it coming because your systems don’t properly track the difference between physical inventory, reserved inventory, and available inventory.

Proper inventory systems handle this with clear states: on hand (physical), allocated (reserved for orders), available (can be sold), on order (expected to arrive). Most eCommerce setups track maybe two of these four states, badly. Then wonder why stock levels don’t make sense.

The returns and refunds gap

Here’s another sync problem that doesn’t get enough attention: returns processing creates inventory data that often doesn’t flow back correctly.

A customer returns a product. Your warehouse receives it, inspects it, and adds it back to available inventory in the WMS. Great. But does that update sync to your eCommerce platform? And if it does, how long does it take?

We’ve seen stores where returns show back in stock in the warehouse system within an hour but don’t appear as available online for 24 hours or more because nobody configured the reverse sync properly. Or it only syncs in one direction—outbound sales update quickly, inbound returns update slowly or not at all.

The reverse problem exists too. A customer requests a refund but hasn’t shipped the product back yet. Some systems immediately add that unit back to available inventory. Now you’re showing stock you don’t actually have yet because it’s still in transit from the customer. If someone buys it before the return arrives, you’re back to overselling.

Or partial refunds and damaged returns—items that come back but can’t be resold. These need to be removed from inventory but not added back to available stock. If your systems aren’t properly tracking item condition and only care about quantity, you end up with bad units being counted as sellable inventory.

Returns processing is complicated. Most businesses focus on the customer service and accounting side—processing the refund, updating financial records. The inventory accuracy side gets less attention, and that’s where sync problems breed.

The variant complexity that breaks everything

Simple products are easy. One SKU, one stock count, straightforward sync. But add variants—sizes, colors, configurations—and complexity explodes.

A shirt in five sizes and four colors is technically 20 different SKUs. Your warehouse might track all 20 individually. Your eCommerce platform needs to show the right stock for each combination. Sync needs to update all 20 correctly and map them properly between systems.

This is where we see the most spectacular sync failures. Size Medium in Blue shows out of stock online, but the warehouse has 30 units. Why? Because somewhere in the SKU mapping between systems, that specific variant isn’t matching up correctly. The data is there. It’s just not flowing to the right place.

Or variant stock gets aggregated wrong. You have 5 units of Small, 10 of Medium, 15 of Large. The product page shows “30 in stock” without breaking down by size. Customer adds a Large to cart. Site says it’s available because there’s stock. But actually all Larges were sold two hours ago and the sync hasn’t caught up. The 30 units showing are all Small and Medium. Customer checks out, gets confirmation, then gets the apology email when fulfillment realizes the mistake.

The more variants you have, the more opportunities for sync to break in subtle ways that are hard to detect and diagnose. And most businesses don’t have good monitoring that would alert them when specific variant SKUs stop syncing correctly.

The custom logic that nobody documented

Over time, most inventory systems accumulate custom business logic that affects stock availability in ways that aren’t obvious.

Maybe you reserve a minimum quantity of certain items for wholesale customers. Or you limit how much online customers can buy of fast-selling items to prevent stockouts. Or you have pre-order logic that allows selling beyond current stock. Or you’ve set up safety stock buffers so the website shows zero before you’re actually out.

This logic is often implemented partially in the warehouse system, partially in middleware, partially in the eCommerce platform. And rarely is it well documented. When stock numbers don’t make sense, nobody can confidently explain what all the business rules are that might be affecting the count.

We’ve spent hours debugging stock inconsistencies only to discover there was a reservation rule implemented three years ago by a developer who’s no longer with the company, and nobody remembered it existed. The rule made sense at the time. It’s still running. It’s affecting stock availability. But it’s not documented anywhere and no one knew to look for it.

This is the difference between setups that work and setups that used to work. Working systems are designed with clear, documented logic. Systems that used to work are archaeological sites of accumulated changes where nobody really knows what all the rules are anymore.

What fixing this actually requires

Getting stock sync right isn’t one fix. It’s a combination of technical implementation, monitoring, and discipline.

First, you need actual real-time or near-real-time sync. Not “runs every hour.” Not “updates overnight.” Every few minutes at minimum, ideally faster for high-volume stores. The technology supports this. If you’re not using it, you’re choosing to operate with stale data.

Second, you need proper reservation logic that distinguishes between stock on hand, stock allocated, stock reserved, and stock available. Systems that only track “total quantity” create problems. You need clear inventory states and transitions between them.

Third, you need monitoring that actually tells you when sync breaks or degrades. Alerts when sync fails. Dashboards that show sync lag time. Reports that catch when specific products or variants stop updating. Most stores have none of this and only discover problems when customers complain.

Fourth, you need documentation of all the business logic affecting stock availability. Every reservation rule, every allocation strategy, every buffer or threshold. Written down. Maintained. So when problems occur, you know what you’re troubleshooting.

Fifth, you need regular audits that compare what systems think stock is versus what it actually is. Not just physical cycle counts in the warehouse, but full end-to-end checks that verify the warehouse count matches the WMS matches the eCommerce platform matches what customers see. Most stores only check one or two of these connections, not the whole chain.

None of this is conceptually difficult. But it requires treating inventory sync as a critical system that needs active management instead of set-it-and-forget-it infrastructure.

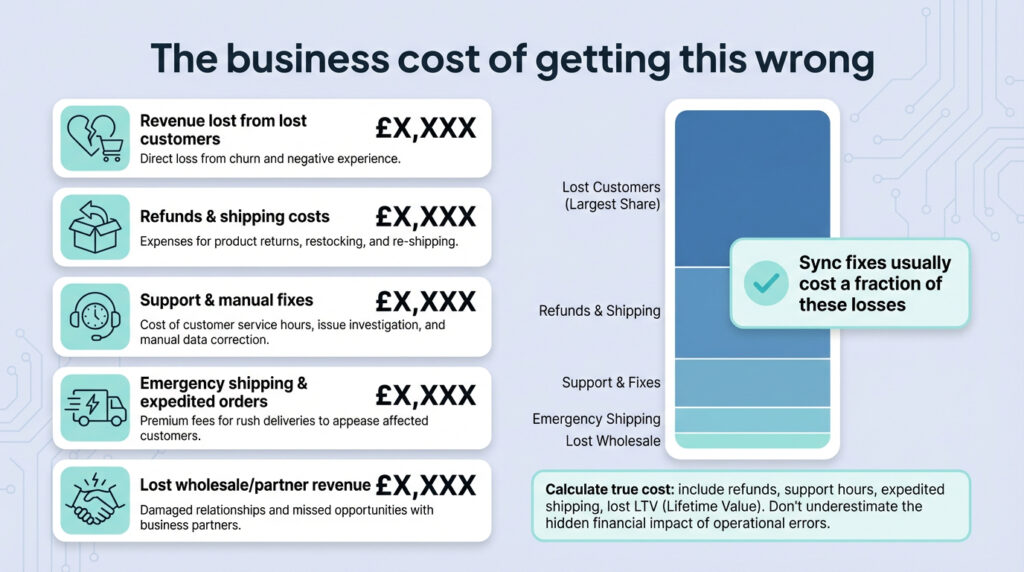

The business cost of getting this wrong

Stock inconsistency directly costs revenue in multiple ways.

Overselling means refunds, apologies, and damaged customer relationships. Someone who gets a “sorry, we don’t actually have this” email after ordering probably isn’t coming back. You’ve lost that sale plus all future sales from that customer.

Understocking—showing items as unavailable when you actually have them—means lost sales to customers who would have bought if they’d known stock existed. This is often worse than overselling because you don’t even know it’s happening. No complaints, no refunds, just silent revenue loss.

Support time spent handling stock-related issues adds up. Every “where’s my order?” email that exists because someone bought something you didn’t have. Every phone call explaining why the item they ordered isn’t available. Every manual inventory check because the systems can’t be trusted.

Emergency shipping costs when you have to source a product from another location because the system said you had it locally but didn’t. Or expedited supplier orders to cover sales you shouldn’t have made. These costs are often invisible in the overall budget but they’re real.

Lost wholesale relationships when you can’t fulfill bulk orders because retail sales ate through inventory that should have been reserved. Or lost retail relationships when wholesale commitments prevent filling retail orders. Either way, someone’s unhappy and reconsidering working with you.

All of this because data isn’t flowing correctly between systems. The actual operational cost is probably minimal—fixing sync is almost always cheaper than living with bad sync. But most businesses never calculate what stock inconsistency is actually costing them, so they never prioritize fixing it.

Why this isn’t getting fixed

We know why stock sync problems persist: they’re not dramatic enough to force action.

A complete system failure gets immediate attention. If your website goes down, that’s a crisis. If payment processing breaks, everyone drops what they’re doing to fix it. But stock sync that’s 95% accurate? That’s just annoying background noise that everyone learns to live with.

The people who experience the pain—customer service, fulfillment teams, customers—aren’t usually the same people who control the technical budget and priorities. CS complains about stock issues. Fulfillment complains about oversells. But those complaints get filed as operational problems, not technical debt.

The developers or IT team who could fix it often don’t even know there’s a problem. They set up the integration once. It works. They moved on to other priorities. Nobody tells them it’s degraded or that there are edge cases causing issues because everyone assumes that’s just how eCommerce works.

And the business leadership sees the overall numbers—total sales, total orders, total revenue—without visibility into how much potential revenue is lost to stock inconsistency or how much cost it’s creating in support and emergency fulfillment.

So the problem persists. It’s on everyone’s list of “things we should probably fix sometime” but never urgent enough to actually prioritize until something dramatic happens—a major oversell situation, a big client lost over stock issues, a peak season disaster where everything falls apart.

What actually works

The stores that have accurate inventory across channels aren’t running on better platforms or more expensive software. They’ve just set things up properly and maintained them.

They have clean data flows with documented logic. They know exactly how inventory moves through their systems and what affects availability at each point. They can trace a stock count from warehouse physical inventory through every system to what displays on customer-facing channels.

They monitor sync health actively. They know within minutes if sync stops or slows. They have alerts for when stock levels seem wrong or when discrepancies appear between systems. Problems get caught and fixed before customers see them.

They’ve eliminated redundant systems and data sources. There’s one source of truth for inventory, and everything else pulls from it. They’re not maintaining separate inventory pools or trying to keep multiple systems manually synchronized.

They test the full flow regularly. They don’t just assume sync works because it worked yesterday. They run test orders, check that inventory decrements correctly everywhere, verify returns flow back properly, confirm reservation logic behaves as expected.

This level of discipline isn’t common, but it’s not complicated either. It’s just treating inventory sync as critical infrastructure that needs ongoing attention instead of something you set up once and ignore.

If your stock keeps lying to customers

If you’re dealing with regular stock inconsistencies—oversells, phantom stock, inventory that doesn’t match reality—you already know it’s a problem. The question is whether you’re ready to actually fix it instead of continuing to treat the symptoms.

You can keep training warehouse staff on procedures that aren’t actually the issue. You can keep apologizing to customers and processing refunds. You can keep firefighting individual incidents without addressing the underlying cause. Many stores operate this way for years.

Or you can audit how inventory actually flows through your systems, identify where sync is breaking or too slow, fix the technical problems, and implement monitoring so you know it stays fixed.

That’s work we do at BrandCrock. Taking the time to map out the entire inventory data flow, identify sync gaps and timing issues, fix integration problems, and set up proper monitoring. It’s not glamorous work—nobody’s going to write a case study about how your inventory sync finally works correctly—but the impact on operations and customer experience is immediate and substantial.

If you’re tired of warehouse teams getting blamed for technical problems, or tired of losing revenue to stock inconsistency, reach out. We’ll look at your specific setup and tell you honestly where the sync is breaking and what it would take to fix it.

Because the goal isn’t selling you development work. It’s helping you stop losing money and trust over a problem that’s completely fixable. Your warehouse is probably doing its job fine. It’s time to make sure your systems are doing theirs.